tax service fees fha loans

FHA loans often involve a tax service fee for the management of the escrow impound account. A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay.

A tax service fee directly benefits the loan servicing company or the.

. The answer to this question. A legitimate closing cost used to ensure that mortgagors pay their property taxes. For example in 2006 HUD changed its policy on non-allowable fees significantly reducing the number of items a borrower could not pay.

FHA loans often involve a tax service fee for the management of the escrow impound account. According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions. Can you charge a tax service fee on an FHA loan.

Related

- garden view nursery irwindale ca 91706

- $200 no deposit bonus 200 free spins texas

- animal crossing halloween ideas

- e ink phone uk

- urgent care five forks simpsonville sc

- can you use gift cards on depop

- nso stock option tax calculator

- nj property tax relief check 2020

- the hair district edina

- why is moderna stock falling dec 1 2020

However the tax service fee is less. What are tax service fees. Hazar or Flood Insurance Premiums.

Mortgagee Letter 06-04 virtually eliminated the prohibited closing costs with the exception of the tax service fee. The same letter prohibited loan origination fees of more than 1 percent. Borrowers may not pay a tax service fee because it is a third-party service.

Tax filers that use tax preparers like HR Block or Jackson Hewitt and are expecting to get an income tax refund loan could be in for a rude awakening this year. HUD noted that elimination of itemized. The maximum fee must be a reasonable and.

Loan for Tax Refund Lenders Available Loan for tax refund - Get your refund much faster and get up to 1000 all without leaving your home or office. Tax Service Fee. A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay.

The gist of the questioncan an FHA loan applicant be charged a tax service fee as part of closing costs or other loan-related fees and expenses. FHA is adding the Third Party Property Tax Verification Fee to the list of allowable charges and fees that may be paid by the mortgagor. Tax Service Fee 50 This fee is paid to research the existing property taxes.

A tax service fee is typically paid by the buyer at the time the home is. For loans through the end of 2009 the origination fee was limited to. Recording Fees - Actual Fees.

The one percent fee cap was eliminated for loans originated after that time but the FHA does not allow the. Termite initial inspection ok - no repairs unless approved in writing by. Many are finding the.

For loans through the end of 2009 the origination fee was limited to one percent. The tax service fee is one of a variety of closing costs or fees assessed when a mortgage becomes official and a home sale is completed.

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Fha Loan Vs Conventional Loan Key Differences New American Funding

Tax Service Fees For Va Fha Loans Hud Handbook

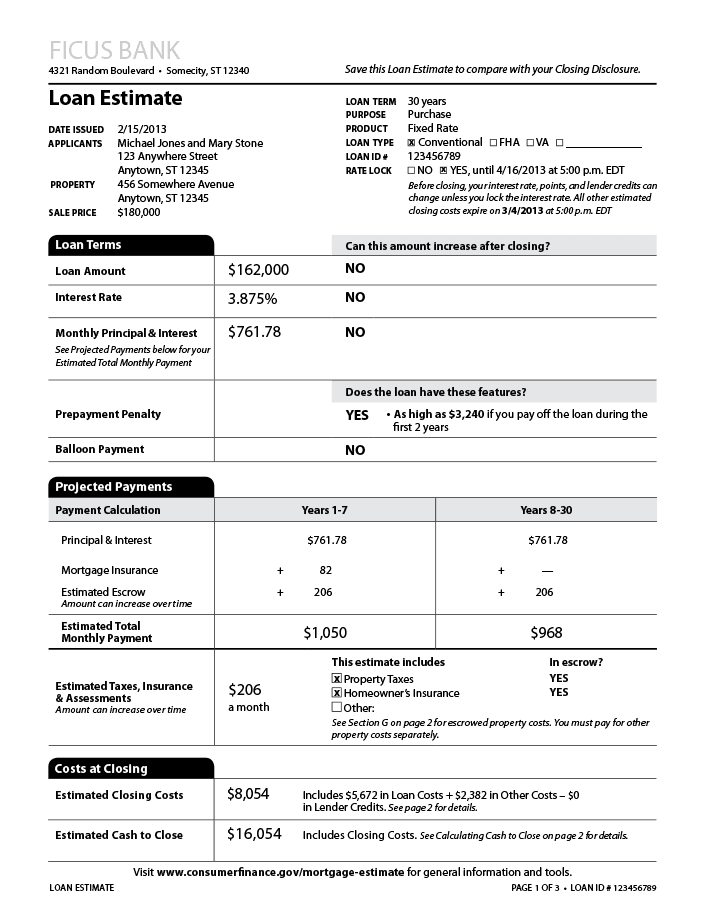

What Is A Loan Estimate How To Read And What To Look For

Fha Closing Costs Complete List And Estimate Fha Lenders

Fha Loan Vs Conventional Loan Key Differences New American Funding

Closing Costs What Are They And How Much Rocket Mortgage

Mortgage Impounds Vs Paying Taxes And Insurance Yourself The Pros And Cons

Loan Estimate Explainer Consumer Financial Protection Bureau

The Best Lenders For Fha Loans In October 2022

Mortgage Closing Costs 101 Arizona Real Estate

Fha Closing Costs For 2021 Nerdwallet

Fha Loan Closing Costs What You Need To Know Chase

2022 Fha Loan Guide Requirements Rates And Benefits

Fha Loan Requirements For 2022 Nerdwallet

Making Fha Small Dollar Mortgages More Accessible Could Make Homeownership More Equitable Urban Institute

Tax Service Fees Fha Loans Mangihin Com

Are My Tax Returns Required For An Fha Loan